The Original Social Network: How a Chit Fund Actually Works

At its heart, a chit fund is a type of Rotating Savings and Credit Association (ROSCA), a system found in cultures across the world. The mechanism is elegant in its simplicity. A group of people-say, 20 members-agrees to contribute a fixed amount of money-say, ₹5,000-every month for 20 months. This creates a monthly "pot" of ₹100,000. Each month, the pot is given to one member of the group. Who gets it? That's where it gets interesting. It can be decided by a simple lottery, or, more commonly, through an auction. Members who need the money urgently will "bid" for the pot, offering to take a discounted amount. The lowest bidder wins the pot for that month, and the discount they offered is distributed as a dividend to all the other members. It's a savings plan, a loan source, and a community investment vehicle, all in one.

The Trust Problem: Why the Old Model Was Risky

For all its brilliance, the traditional, paper-based chit fund model was built on a fragile foundation. It relied entirely on the trustworthiness of the organizer and the social pressure within the community. The system was opaque. Members didn't always know who had paid and who hadn't. The biggest risk was always the human element. A dishonest organizer could simply disappear with the group's money, leaving the members with no formal recourse. For any platform involving groups of people and financial outcomes, clear rules and a transparent system are non-negotiable. This is true for a community savings group, and it's equally true for a modern entertainment platform like the aviator game app, where users need to trust the fairness of the system to participate. The goal of digitizing chit funds is to replace this reliance on blind faith with the verifiable trust of a rule-based digital platform.

Putting Trust on the Blockchain: The Power of the Digital Ledger

This is the core problem that fintech startups are now solving. They are taking this ancient system and putting it on a modern, transparent, and secure digital platform. The handwritten ledger is replaced with a digital one, often secured by a blockchain. This creates radical transparency. Every member of the group can log into the app and see in real-time who has made their monthly contribution and who is overdue. Payments are automated through digital systems like UPI, eliminating the hassle of collecting cash. Auctions are conducted digitally within the app in a clear and fair process. By moving the entire operation onto a verifiable digital ledger, these apps don't eliminate the need for trust-they digitize it. They make trust the default setting of the system, rather than just a hope.

From Community to Credit Score: The Data-Driven Advantage

Here is where the fintech innovation goes a step further. The app doesn't just manage the chit fund; it creates a valuable new asset for its users: a credit history. Millions of people in India, especially small business owners and those in the informal economy, are "credit invisible." They have no formal record of their financial reliability, which makes it nearly impossible for them to get a loan from a traditional bank. The digital chit fund app changes this. By faithfully making their monthly payments within the app, a user creates a rich, verifiable data trail of their financial discipline. The fintech platform can then use this data to generate a unique credit score for the user. This score can then be used to help that person access other financial products, like small business loans or personal credit, bridging the gap from the informal economy to the formal financial system.

Navigating the Regulatory Maze: The Challenge of Gaining Legitimacy

While the technology is powerful, the path to mainstream adoption is not simple. Chit funds in India have a complicated history and a mixed reputation due to past scams by unregistered operators. The industry is heavily regulated by both central and state governments. New fintech companies in this space have to walk a very fine line. They must navigate this complex regulatory maze, ensuring they are fully compliant with the law. But they also have to win the trust of two very different groups. They must win the trust of a user base that is accustomed to the old, informal, relationship-based system. And they must win the trust of regulators, proving that their technology makes the system safer and more transparent, not just a digital version of the risky old model. Gaining this dual-sided trust is the biggest challenge they face.

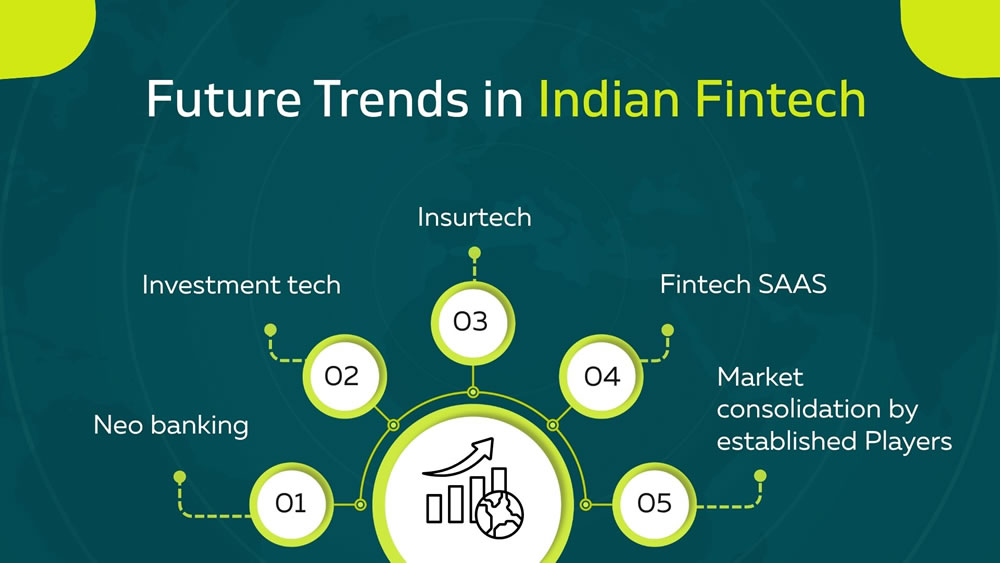

Conclusion: The Future of Community Finance

The digitization of the chit fund is a powerful example of how technology can enhance, rather than erase, traditional cultural practices. It’s not about replacing a community-based system with a cold, impersonal algorithm. It’s about taking a system that was already built on the brilliant idea of social collaboration and giving it the tools of the 21st century. By adding transparency, security, and a bridge to the formal financial world, these fintech apps are preserving the communal spirit of the chit fund while eliminating its biggest risks. It’s a glimpse into the future of community finance, a future where ancient wisdom and modern technology can work together to build a more inclusive and trustworthy financial world for everyone.